[Video] What To Do Before Signing The Contract of Sale?

Hunting for a property is exciting but is not always the most difficult part of the property purchase journey… Once you find the property you are after, you need to follow the steps below to ensure there are no unanticipated issues come settlement day. This is the day that the property is finally legally yours.

While you are still actively searching

1. Let your Mortgage Broker or Loans Advisor know you have started your search so that they are aware of the situation and are prepared.

2. Select a Conveyancer or Solicitor while you are actively looking for a property. This saves the mad rush of finding someone to act for you once a property is found.

Once you find the property you like

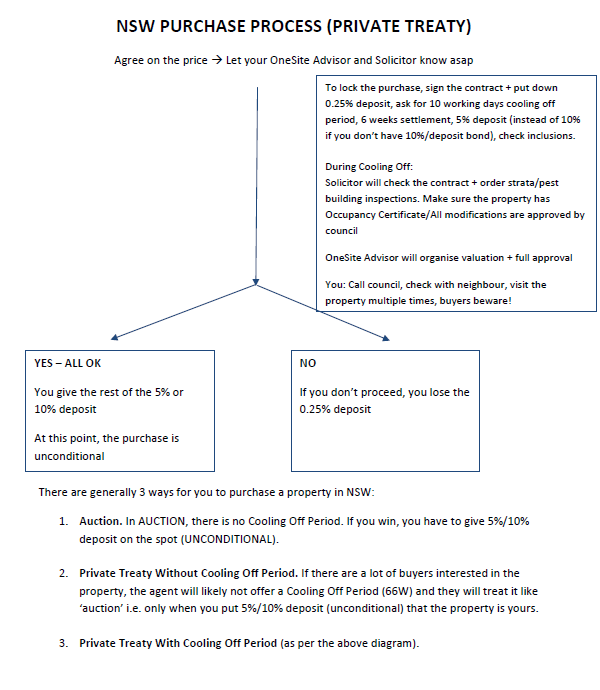

3. Negotiate the price with the Agent. Once you agree on the price, your Mortgage Broker will order the Lender valuation/let the Lender know. If there are any changes, you will need to inform your broker (example: changes to purchaser’s name, purchase price/special condition, exchange/cooling off/settlement date, your income/living expenses/liability situation) as any changes may require further re-approval by the Lender. Please let your broker know BEFORE making any changes. Any rebate conditions need to be communicated to the Lender.

4. Ask your Conveyancer or Solicitor to review the contract of sale BEFORE signing and exchanging the contract. They will advise you whether you need to make changes, do inspections (e.g. strata, building, pest), and so on, as part of your due diligence process BEFORE signing the contract of sale.

How much is the deposit?

5. Negotiate with the Agent before signing the contract the following conditions:

- 10 working days cooling-off period – allows you to pull out if your inspections uncover any issues (Note: In NSW, 5 working days cooling off period is the norm but please ask for 10 working days cooling off possible)

- 5% deposit to proceed – if 5% is not possible, 10% is OK. This is the deposit that you will pay once the cooling-off period expires in order to proceed

- 6-week settlement period – the longer the settlement period, the better. This allows you to line up your finance and complete any due diligence

- Check all the inclusion boxes are ticked correctly (e.g. Are the following included in the purchase: blinds, dishwasher, dryer etc)

- Check if the property is Vacant Possession or Subject to Tenancies. If you are buying the property as Owner Occupied, most banks would want you to have the property as Vacant Possession at settlement

6. To secure the property during the 10 working days cooling-off period, and take it off the market, you will need to provide 0.25% of the agreed price as a deposit. You then need to sign the contract of sale after it has been agreed upon and reviewed by your Solicitor. If you do not go ahead with the purchase, you will lose the 0.25% deposit.

Is there a cooling-off period?

For example, the bank’s valuation and full approval is done AFTER the Auction. This means you will have to make sure you are confident that you are not paying over the market price, otherwise, this will affect your loan approval. Once you give the 5-10% deposit (non refundable), if you do not proceed, you will lose this deposit.

8. At the end of the cooling-off period, you will need to give the rest of the 5% deposit (the deposit negotiated in step 5). You only provide the full deposit AFTER you receive the Full Approval for your home loan from the Lender and all appropriate inspections are carried out and are satisfactory.

That’s it… Happy hunting!

The video below walks you through more useful information on this topic by our head Mortgage Broker – Elizabeth Zaki