Blog

[Video] How the Interest Rate Increase Will Affect Your Repayments – Nov 2023

The RBA board on Tuesday decided to hike its cash rate 25 basis points to 4.35%, a 12-year high. The increase, widely anticipated by economists, was the central bank’s 13th rate rise since May 2022.

New governor Michele Bullock and the board had lately sent repeated signals they were poised to resume rate rises if inflation didn’t slow as expected. The RBA remains ready to hoist interest rates again if required, she said in an accompanying statement.

Read MoreAre you a Mortgage Prisoner? How to Refinance Your Mortgage

Are you one of the many borrowers feeling trapped in a mortgage with an interest rate higher than the current market rate? Are you looking to refinance your mortgage? You’re not alone. Many borrowers find themselves locked into home loans that prevent them from taking advantage of better rates offered by other lenders.

Well, there’s good news on the horizon! In this blog post, we’ll look at the refinance process and potentially save you money on your new mortgage. Read on to discover how you may be able to escape the clutches of high interest rates to refinance your mortgage and secure a better deal for yourself.

Read More[Video] How the Interest Rate Increase Will Affect Your Repayments – May 2022

For the first time since November 2010, the RBA has raised its official cash rate – from 0.1% taking it to 0.35%. This was above market expectations for a 0.15% hike, and a bit closer to our expectation for a 0.4% move. This article will take you through how this interest rate increase will affect your repayments.

The RBA appears to have partly accepted the argument that it had to do something decisive in order to signal its resolve to get inflation back down. It also announced that it will start quantitative tightening, by allowing its portfolio of bonds on its balance sheet to run down as they mature.

Read More[Video] What To Do Before Signing The Contract of Sale?

Hunting for a property is exciting but is not always the most difficult part of the property purchase journey… Once you find the property you are after, there are 8 things to do before signing the contract of sale.

This ensures you minimise your loss if you don’t end up proceeding with the purchase, and you ensure there are no unanticipated issues before settlement day.

We cover what to do:

– While you are searching for the property

– When you find a property you like

– What to negotiate once a price is agreed

– While reviewing the contract of sale

What is the First Home Super Saver Scheme – FHSS?

The First Home Super Saver Scheme (FHSS) is an Australian Government initiative, allowing you to save for your home inside your super, helping first home buyers save faster with the concessional tax treatment of superannuation.

The FHSS was introduced by the Australian Government to reduce pressure on housing affordability. It is designed to allow first home buyers to save towards a home deposit in their super fund. Under the FHSS Scheme, you can make either before-tax contributions or after-tax contributions to your super account. You can then request a release of the funds when you are ready to buy a home to live in.

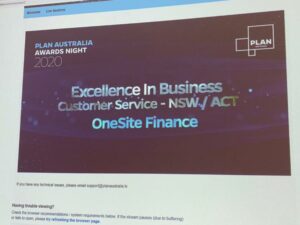

Read MoreExcellence in Customer Service – Mortgage Industry Award

On Friday, 20 November 2020, the team at OneSite Finance was thrilled to win PLAN Australia’s award for Excellence In Business – Customer Service for NSW/ACT for 2020.

As with everything in 2020, PLAN Australia’s Awards Night was held remotely! But not to be outdone, the OneSite Finance team had their own party in the office.

The team was commended for their exemplary service during 2020 with all its challenges, as well as leading up to it.

Read More