Home Loans

[Video] Can I Get a Home Loan While on Maternity Leave?

These days, most lenders have maternity/parental leave in their policy so the answer is YES, they can consider your application.

To get a home loan, you will need to get a RETURN-TO-WORK letter from your employer (if you work as PAYG employee) detailing the following information:

– Your name

– Your occupation

– Start date of employment

– Current employment type e.g. Full time/Part time permanent

– Current salary (Gross, Net, Superannuation)

– Start date of maternity or parental leave

…

What Is Land Tax?

Land tax is an annual tax levied at the end of the calendar year on property you own that is above the land tax threshold.

Your principal place of residence is exempt from land tax, and other exemptions and concessions may apply.

We will discuss Land Tax as it applies in NSW but the concepts are largely similar across all of Australia’s other states.

You may have to pay land tax if you own, or jointly own:

– vacant land, including rural land

– land where a house, residential unit or flat has been built for investment purposes

– a holiday home

– an investment property or properties

– company title units

– residential, commercial or industrial units, including car spaces

– commercial properties, including factories, shops and warehouses

– land leased from state or local government

Are you a Mortgage Prisoner? How to Refinance Your Mortgage

Are you one of the many borrowers feeling trapped in a mortgage with an interest rate higher than the current market rate? Are you looking to refinance your mortgage? You’re not alone. Many borrowers find themselves locked into home loans that prevent them from taking advantage of better rates offered by other lenders.

Well, there’s good news on the horizon! In this blog post, we’ll look at the refinance process and potentially save you money on your new mortgage. Read on to discover how you may be able to escape the clutches of high interest rates to refinance your mortgage and secure a better deal for yourself.

Read More[Video] What To Do Before Signing The Contract of Sale?

Hunting for a property is exciting but is not always the most difficult part of the property purchase journey… Once you find the property you are after, there are 8 things to do before signing the contract of sale.

This ensures you minimise your loss if you don’t end up proceeding with the purchase, and you ensure there are no unanticipated issues before settlement day.

We cover what to do:

– While you are searching for the property

– When you find a property you like

– What to negotiate once a price is agreed

– While reviewing the contract of sale

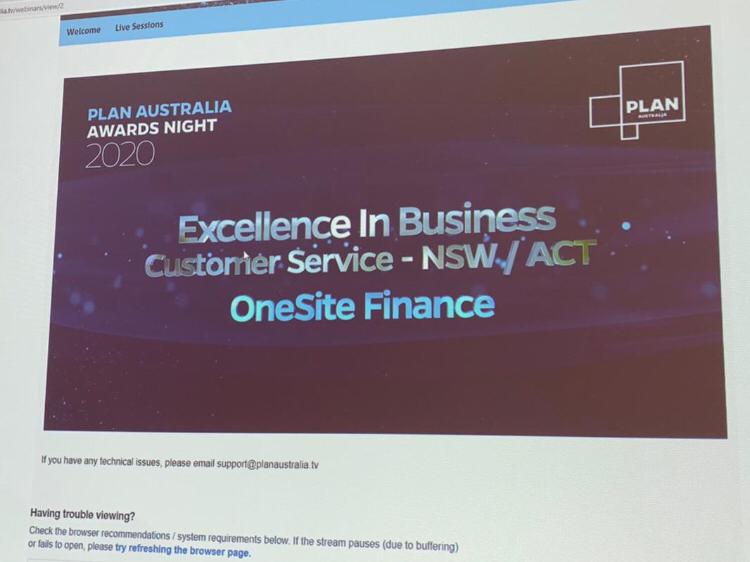

Excellence in Customer Service – Mortgage Industry Award

On Friday, 20 November 2020, the team at OneSite Finance was thrilled to win PLAN Australia’s award for Excellence In Business – Customer Service for NSW/ACT for 2020.

As with everything in 2020, PLAN Australia’s Awards Night was held remotely! But not to be outdone, the OneSite Finance team had their own party in the office.

The team was commended for their exemplary service during 2020 with all its challenges, as well as leading up to it.

Read More[Video] Building Your Home: The Land & Construction Loan Process

Building your home can be a long and challenging process. This is in no small part due to the land and construction loan process.

This guide outlines the journey you will go through. From purchasing the land to constructing your dream home. This article will show you what to do at each step. What to ask for. What pitfalls to steer away from.

The guide will also go through the different steps involved in the land and construction loan process. This is the process of obtaining finance to complete your home building project.

Read More[Video] Upgrading Your Home? Keep Or Sell Your Existing Home?

Are you thinking of upgrading your home? Many clients want to know what to do when they want to move homes.

Can you keep your existing home as an investment and buy a new one? Should you sell your existing home first, and then buy?

Should you buy first, and then sell your existing home to get the best return? Do you need short-term bridging finance to make this happen?

This video will walk you through the different strategies you can use when upgrading your home. Each strategy has its own pros and cons.

Read MoreWhen Should I Fix My Home Loan?

One of the things you need consider when looking for a home loan is whether or not to use a fixed or variable interest rate based home loan product.

To fix, or not to fix… That is the question.

Shakespeare aside, this is one of the bigger decisions you need to make when you’re looking to get a home or investment loan.

Whether you are a first home buyer or a seasoned property investor, there are a number of things to consider once you’ve decided to fix. Things like:

– How much of your home loan to fix

– How long to fix your interest rate for

Lenders Waive LMI For Professionals In Certain Industries

If you are working in certain professions, a number of banks or lenders are willing to waive the LMI premium for you. These lenders may lend without charging the Lender’s Mortgage Insurance (LMI) fee if you have between 10% to 20% deposit depending on certain qualifying criteria.

Lenders and banks may waive the LMI for accredited professionals in the accounting, finance, legal and medical industries depending on a number of criteria.

Read MoreCoronavirus Mortgage Repayment Relief

Some people have lost their jobs. Some have had their businesses shut down. Others have had their wages reduced. If you are financially impacted by COVID-19, we have created this article and accompanying video to walk you through the options put together by the different lenders.

Almost all bank’s home pages now have a link which will take you to their financial assistance policies if you are impacted by coronavirus. This article will walk you through the main options you have, along with the pros and cons of each option.

Read More