Interest Only Loans Under Scrutiny

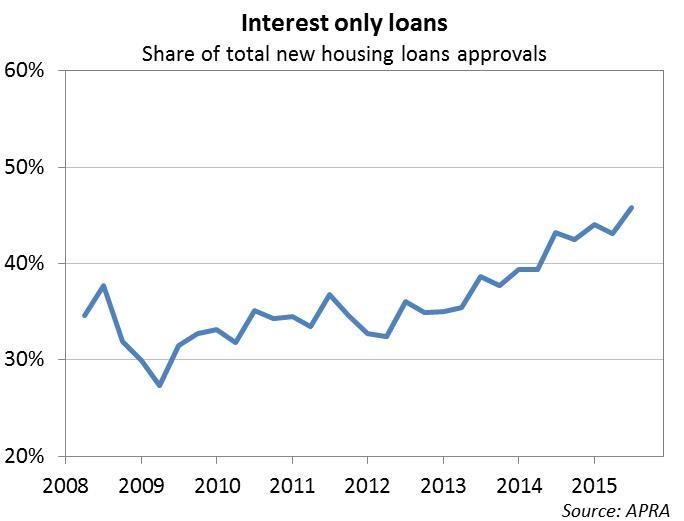

Interest only home loans have grown substantially since 2012. When ASIC reviewed the market in mid 2015, it found that the total value of new interest only home loans issued by banks, credit unions and building societies had expanded to account for 43% of all new home loan approvals issued and rising.

A key difference between Interest Only and Principal and Interest (P&I) home loans is their overall cost, with interest only home loans being more expensive in the long term if the customers are just paying the interest only repayment without saving additional amounts themselves.

The use of an interest only home loan means that a consumer is in practice trading the benefit of lower repayments during the initial interest only period (including the possible alternative use of money saved in this way) for a higher total cost down the line. This is one of the factors currently fuelling the property market in Australia.

ASIC deems interest only loans to be higher risk than Principal and Interest repayments and as such would like to see a reduction in the overall use of Interest Only Loans. As a result, the banks in Australia have been asked to:

- Place higher interest rates on Interest Only loans products to discourage their use

- Reduce the amount customers can borrow if they choose an Interest Only loan compared to a Principal and Interest loan. In the past, to switch a product from P&I to Interest Only, customers just had to call the bank. Now, a new assessment and loan application is required to change the repayments from P&I to Interest Only.

Interest Only Loan Checklist

With this in mind, the team at OneSite have created this list of tips for you if your loan is currently in an interest only period:

- Contact your Loans Advisor to calculate your monthly repayment if your loan was switched to P&I. Aim to save the difference in your Interest Only repayment and the P&I repayment yourself.

- See if you can get an offset account attached to your loan. This will help you to save the on the interest payments or pay extra towards the loan.

- Be aware of the limitations – Ask your Loans Advisor about how Interest Only loans work and when you should be using them. Like all financial products, they have a number of pros and cons. Please see the following article on the Money Smart website for more information on Interest Only Mortgages.

- Set yourself a reminder to contact your OneSite Loans Advisor about 8 weeks prior to the expiry date of the Interest Only period to make sure your situation is assessed again at that time.

- Be prepared to pay the higher repayment (Principal & Interest) if your interest only period cannot be extended. If you have some savings, perhaps you can use those to lower the loan balance in order to reduce your P&I repayments.

- SAVE, SAVE, SAVE 🙂