Home Loan Guide

What To Do Before Applying For A Loan

Are you thinking of purchasing a property? Do you need to borrow to make that happen?

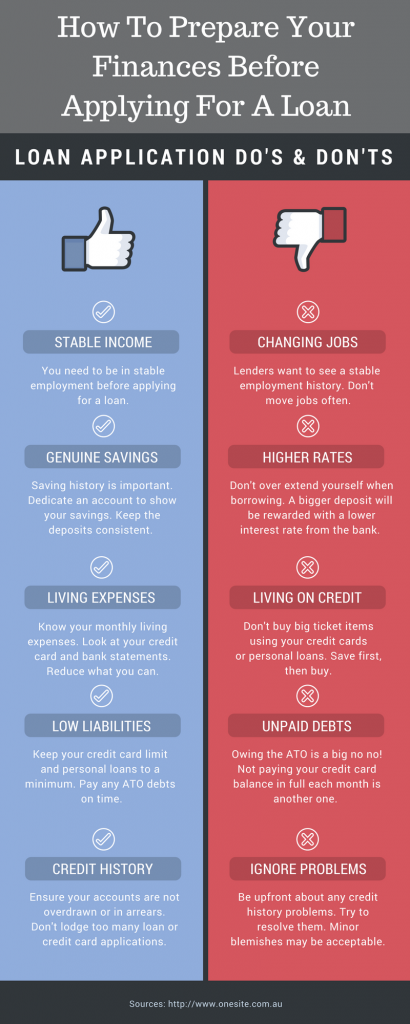

Whether you are looking for a home or an investment loan, here are some things you need to do before applying for a loan.

Set a Clear Goal

It is always best to start with some clear goals in mind. What are you buying? Where? How much do you need to borrow roughly?

Seek Professional Advice

Before applying for a loan, it is advisable to speak with your professional advisors (your accountant, solicitor, buyer / property agent and so on) to ensure that the new purchase is arranged under the optimal structure.

You need to check - are you better off buying under your personal name, under a company or a family or unit trust. Getting this right up front will save you many headaches down the line.

If you have an existing property, we might first need to get a property valuation done to calculate your equity.

Your Income

The Lenders like to see a stable employment history and consistent income. It is important to avoid changing jobs before applying for a loan.

If you are working on a casual or contract basis, ensure that you stay with your current employer for at least 3 months (most banks need 6-12 months) before applying .

If your income consists largely of bonuses or commissions, you will definitely need to be in the same employment for at least 12 months. Some banks only look at bonuses if you have been in the same job for 2 years.

If you are self-employed, ensure that your profit is consistent over the years.

Ensure that your income is being deposited into your bank account and that it matches the income stated on your pay slips and tax returns.

Ensure all your tax returns are up to date and that all your outstanding tax liabilities are paid.

If you receive an income or benefits from the Centrelink, don't forget to let your Mortgage Broker know.

If you are going on maternity leave or are already on maternity leave, don't worry. Some Lenders can still use your income providing that you have a letter from your current employer stating your date of return and salary.

Enquire Now. Book Your FREE Home Loan Strategy Session

Discover how to get the right home or investment property loan and save years and thousands in repayments, fees and taxes

Your Savings

As you can imagine, the higher your savings, the better you look to the Lenders.

If you have a current mortgage with a mortgage offset account, place your savings into this offset account. If nothing else, it will be saving you 4-5% of interest.

With some Lenders, you can have multiple offset accounts connected with your loan account. Some people love this because it allows them to budget better (i.e. they have one offset account to track their day to day expenses, they have another offset to track their holiday savings etc).

If you don't have a mortgage offset account (and don't have a current mortgage), then it’s better to have a dedicated account to keep your savings in.

Avoid taking money in and out in large chunks because it will affect your savings history.

If you plan on borrowing more than 85% of the value of the property, you have to prove to the Lender that you saved at least 5% of the property price yourself - in your own bank account. This is called genuine savings.

If you parents are giving you a non-refundable gift, you have to keep at least that 5% portion in your bank account for at least 3 months.

Lenders want to see your savings balance increasing every month! It shows that you are a great saver and have a great level of commitment. Essentially, you look like a smaller risk to their credit assessors which makes you a customer they want to do business with.

Living Expenses

How much you can borrow depends largely on your monthly living expenses. The higher your living expenses, the less you can borrow.

Use the following budget planner at the Government's Money Smart website to help you tracking your living expenses: https://www.moneysmart.gov.au/

Completing the budget planer is a great exercise to find out where your money is going and whether you can reduce your spending in some areas to increase your savings!

You will be surprised at how small expenses add up.

Your living expenses must be consistent with your credit card bills and direct debits shown on your bank account.

Pay all your bills on time!

Consistent late payment or being in arrears is a big NO NO!

Lenders see this as you being irresponsible and will penalise you when scoring your loan application.

You should spend when you can afford to. Avoid buying high ticket items and holidays using your credit card or a personal loan. Save, then spend!

Please see the following article on how to reduce your living expenses: https://www.moneysmart.gov.au/

Find a Home Loan That Suits Your Current and Future Needs

Liabilities

The number one rule here is to pay all your liabilities on time. As we said before arrears are big NO NO!

This includes your rent if you are renting. Having a great rental history can count towards your 5% genuine savings with some lenders.

All your tax liabilities must be paid. On time.

If you have a Tax Arrangement with the ATO, please let your Mortgage Broker know as some Lenders will penalise you heavily or even require this debt to be paid out first.

If you have a HECS debt, please let your Mortgage Broker know. It may be beneficial to your borrowing capacity (how much money a bank will lend you) to pay your HECS debt out before applying for a loan.

Don't have too many credit cards!

The total available limit on each credit cards is a liability, not just the outstanding balance. The more credit cards you have and the higher their limit, the less you will be able to borrow!

Clear your credit cards outstanding balance amount every month. The interest you pay on your credit card is so high anyway! This eats away at your borrowing capacity.

If you have personal loans, work on paying these off as quickly as possible because the interest rate is high! Again, this will eat away at your borrowing capacity.

If you are self employed or own your own business, let your Mortgage Broker know. Any business loans, leases or other forms of credit relating to your business may impact your personal borrowing capacity.

Bank Accounts & Credit History

You need to have a CLEAN credit history when you apply for a loan.

You can check your credit history by ordering a credit history report from: http://www.mycreditfile.com.au/products-services/my-credit-file

Ensure all your bank accounts are never in arrears or overdrawn.

It's great to shop around when looking for finance but do not apply for a loan approval with too many Lenders as this will affect your credit history.

Each loan application whether successful or not is another mark against your file which reduces your credit score.

ID & Paperwork

When you apply for a loan, the Lenders will ask for your identification documents, income evidence, bank statements, loan and credit card statements.

Ensure that you have all your paperwork ready so your approval is not held up!

If you only receive paper statements, don't throw them away.

If you are moving money from one account to another, keep the old statements so that the bank can see the money transfers from one account to another if needed. This is especially important to prove a genuine saving history!

![Closing the deal. Business people closing the deal by shaking hands.

[url=http://www.istockphoto.com/search/lightbox/9786738][img]http://dl.dropbox.com/u/40117171/group.jpg[/img][/url]

[url=http://www.istockphoto.com/search/lightbox/9786622][img]http://dl.dropbox.com/u/40117171/business.jpg[/img][/url]](https://www.onesite.com.au/wp-content/uploads/bb-plugin/cache/iStock_000027255664_Small-panorama.jpg)

Full Disclosure

Ensure that you have all your facts ready before applying for your loan. All your assets, liabilities, income and living expenses have to be fully disclosed on your Loan Application.

Whatever your situation is, we are here to help you! We can advise you how to present and prepare yourself and financial affairs before applying for the loan in order to get your loan approval in one go.

There are Lenders that can cater for outside-the-box or complex scenarios. And we are here to find the most suitable solution for you!

If you are not ready to apply now, don't worry. We will help you create an action plan to track your progress so that you are closer to reaching your goal of buying a property.

At the end of the day, the better you present yourself to the Lenders, the more options you will have for finance. And the faster and smoother the loan application process will go.